Foreclosures in Cyprus: Procedure, Rights, Case Law

Cyprus faced an unprecedented NPL crisis that led to Law 142(I)/2014, introducing Part VIA to the Transfer and Mortgage of Immovable Property Law (9/1965). This framework replaced decade-long court proceedings with a fast-track foreclosure mechanism. After ten years of implementation, critical jurisprudence has shaped how notices, valuations, and debtor rights intersect.

The process is strictly procedural: from Notice Type "Θ" through Type «ΙΓ» sale announcements to final disposition notices. Each step has rigid deadlines—45 days to challenge, 10 days to appoint valuers—where missing one can be fatal. Recent Supreme Court rulings confirm the autonomy of mortgage while EU consumer protection laws offer new defenses against unfair terms.

Critical procedural stages

- Notice Type "Θ": Final warning before formal process (one-time only)

- Notice Type "Ι": Full account statement, 45-day payment deadline

- Notice Type "ΙΑ": The pivotal point—challengeable within 45 days on limited grounds

- Notice Type "ΙΒ": Valuation appointment—10 days or lose control of pricing

- Notice Type "ΙΓ": Post-auction options with sliding reserve thresholds

Strategic defense options

Pre-emptive action beats reactive litigation. File claims questioning debt validity before Type «ΙΑ» arrives, securing Article 32 injunctions that become automatic grounds for setting aside sale notices.

Service defects remain potent—registered mail is mandatory, private service only as fallback. Missing co-owners or primary debtors voids the process. EU consumer laws add ammunition: unfair terms, guarantor protections per Tarcău, mandatory judicial review per Aziz.

Reserve price trajectory

-

1st

Initial auction

Minimum 80% of market value (Article 44E)

-

0-3m

First quarter post-auction

Still 80% minimum for repeat attempts

-

3-6m

Second quarter

Can drop to 50% of market value

-

6m+

After six months

No reserve required OR creditor self-purchase at market value

Recent jurisprudential developments

The Mitsiyiorgi (2025) ruling crystallized mortgage autonomy—hypothecs stand independent of personal debt proof. The Court of Appeal declared Articles 44IH-44KZ unconstitutional for «trapped buyers», violating property and contract rights without fair compensation.

Meanwhile, EU consumer directives penetrate deeper: unilateral rate increases, compound interest capitalization, 360-day calculations all face scrutiny. The District Court in Goodband (2024) prioritized estate administration fees over secured creditors, showing courts' willingness to protect vulnerable parties within statutory bounds.

Deep dive into the full guide

Get the complete analysis—notice templates, case law compendium, and strategic checklists for each procedural stage.

- Explanation notice templates ("Θ", "Ι", "ΙΑ", "ΙΒ", "ΙΓ")

- Curated case law & recent appellate trends

- Stage-by-stage strategy checklists

- Defenses based on EU consumer law

Need immediate guidance?

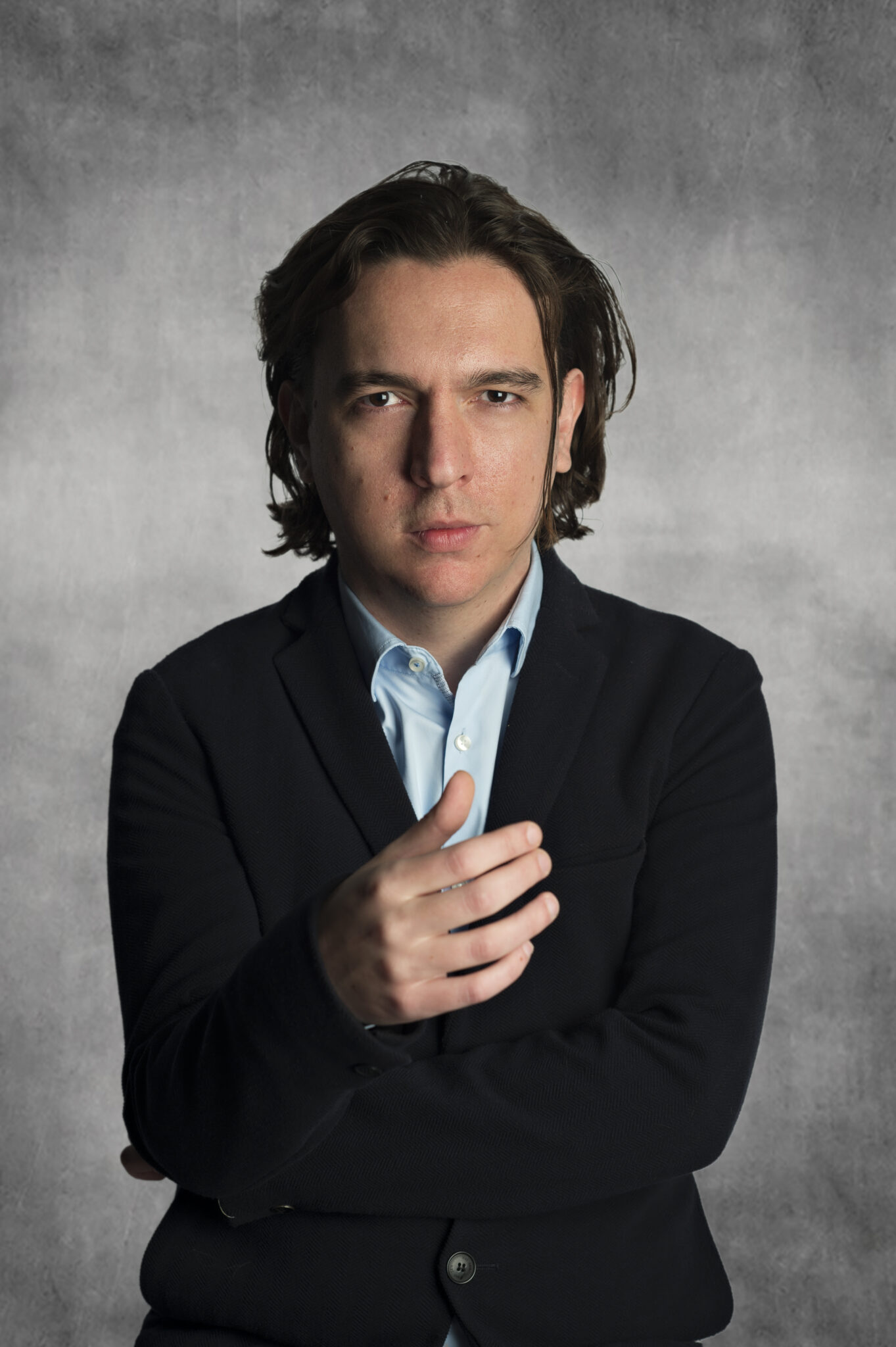

Hi, I’m Panayotis Yannakas

your

Lawyer.

Litigator.

Business Consultant.

Attorney.

With a total of 5 years of professional experience navigating the Cyprus legal regime, I am a licensed Litigation Lawyer with comprehensive experience managing complex court cases, providing expert legal advice, and drafting contracts and legal documents. At my office, I am dedicated to providing personalized solutions that are tailored to your unique needs. My legal expertise has been strengthened by working on the legal research team of Cyprus Central Bank, and I have served as a trusted legal counsel for clients across various legal firms

Contact With Me

Law Office of Panayotis Yannakas

37 Annis Komninis, 6th Office (2nd Floor), Nicosia, PC 1061, Cyprus

Phone: +357.22035352 Email: panayotis@yannakas.me